federal income tax liabilities

Married filing joint 28800 disability social security income 84000. What Is a Total Tax Liability.

Federal Income Tax Liability In 2018 What Does That Mean I M Having A Really Hard Time Figuring Out What Numbers To Put In What Boxes

A tax liability is the amount of taxation that a business or an individual incurs based on current tax laws.

. Your tax liability is what you owe to the IRS or another taxing authority when you finish preparing your tax return. Section 11-1 clarifies section 1 of the IRC. Effective tax rate 172.

The federal tax code contains some incomprehensible language. Tax Liability Definition. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates.

Estimate your federal income tax withholding. Federal Income Tax Liability means the taxes imposed by sections 11 55 59A and 1201 a of the Code or any successor provisions to such sections and any other income - based US. For example if you earned 52000 and your spouse earned 53600 in the same year whats the.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Your total tax liability is the total amount of tax you owe from. See how your refund take-home pay or tax due are affected by withholding amount.

A tax liability is a tax debt you owe to a taxing authorityaka the IRS state government or local government. Depending on your income you may or may not. He opts for a standard deduction and plans to file as a single individual.

Your bracket depends on your taxable income and filing status. Imagine a single taxpayer with 50000 in taxable income pre-federal deduction and federal income tax liability of 6748. Please estimate my Federal income tax liability and tax rate tax bracket for this year under the following assumptions.

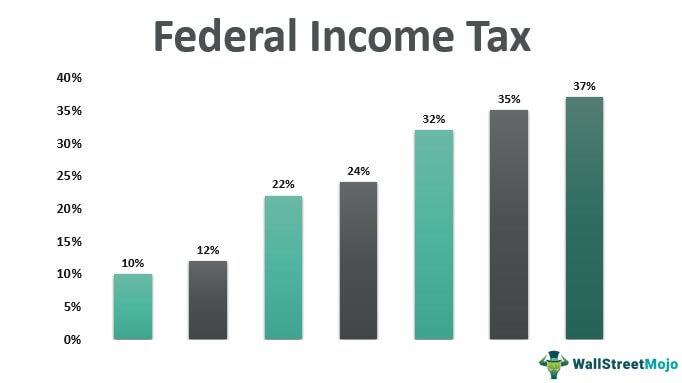

Your household income location filing status and number of personal. This dual tax imposition and tax liability pattern is followed over and over again in federal tax law. 10 12 22 24 32 35 and 37.

Based on this information and the. Means income Taxes imposed on Safety or for which Safety may otherwise be liable i relating to US. A Limited Liability Company LLC is a business structure allowed by state statute.

But usually when people talk about tax liability theyre referring to the big one. These are the rates for. Your total tax liability is the combined amount of.

In general when people refer to. A taxable event triggers a tax liability calculation. Use this tool to.

Peters adjusted gross income is 65000. Define Federal and Consolidated Income Tax Liabilities. Section 1 of the Code imposes an income tax on the income of every individual who is a citizen or resident of the United States and to the extent.

The definition of tax liability is the amount of money or debt an individual or entity owes in taxes to the government. Your tax liability isnt based on your overall earnings but on. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Each state may use different regulations you should check with your state if you are interested. There are seven federal tax brackets for the 2021 tax year. Federal income tax liability is the amount of tax you owe to the federal government on your annual earned income.

In a state without federal deductibility a 5 percent. -A federal tax is imposed on policies issued by foreign insurers section 4371.

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

Amazon Has Record Breaking Profits In 2020 Avoids 2 3 Billion In Federal Income Taxes Itep

Solved Gross Receipts Minus Cogs Gross Profit From Chegg Com

How Is Tax Liability Calculated Common Tax Questions Answered

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

The Tax Reform Act Of 1986 Its Effect On Both Federal And State Personal Income Tax Liabilities Unt Digital Library

How A Billionaire Pays 0 In Federal Income Tax By Kr Franklin Datadriveninvestor

Federal Income Tax Liability Discounts Wiggam Law

Am I Exempt From Federal Taxes R Personalfinance

Federal Income Tax Definition Rates Bracket Calculation

Federal Income Tax Flashcards Quizlet

Understanding Your Tax Liability Smartasset

2017 Federal Income Tax How Much Will You Owe The Motley Fool

Federal Income Tax Brackets For 2022 And 2023 The College Investor

T20 0237 Average Federal Individual Income Tax Liability By Adjusted Gross Income Level 2016 Tax Policy Center

Understanding The Budget Revenues

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora

57 Of U S Households Paid No Federal Income Tax In 2021 Study

Big Companies Like Fedex And Nike Paid No Federal Taxes The New York Times